Governance as a Market: Designing the Future of DAO through Futarchy, AI, and Synthetic Derivatives

Executive Summary

This report presents an innovative paradigm to solve the fundamental governance problems faced by DAO: low participation, decision-making inefficiency, and a lack of accountability. The core thesis is the fusion of Futarchy principles, AI agents, and financial derivatives concepts to transform governance itself into a dynamic financial market. This model goes beyond simple binary prediction markets to build an ecosystem where sophisticated synthetic options, linked to governance proposals and KPI, are issued and traded.

Key findings are as follows. First, a governance-linked options market transforms a DAO's native token from a simple voting right into an essential collateral and medium of exchange for market participation: a 'casino chip.' This exponentially increases the token's trading volume and liquidity, driving an economic flywheel that creates genuine transactional demand beyond speculative interest.

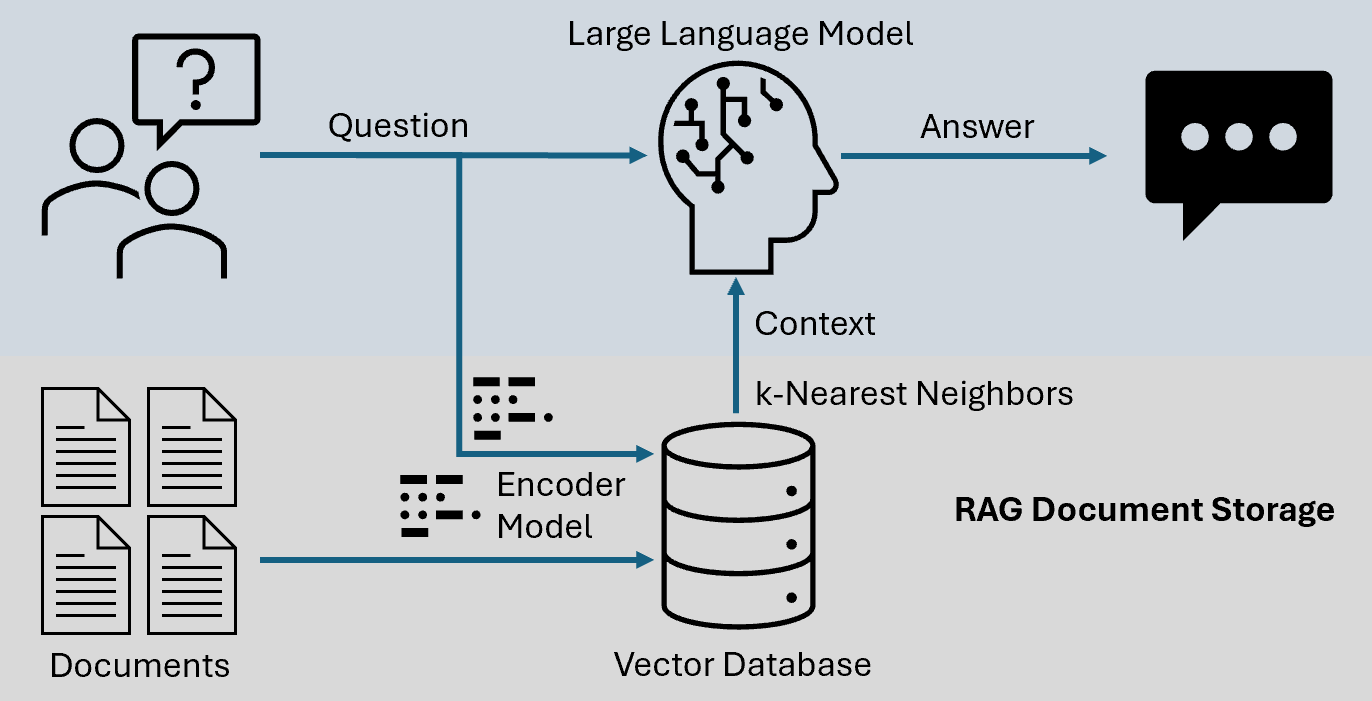

Second, AI agents are a critical element for the expansion and popularization of these complex governance markets. AI performs roles such as information gathering, strategy automation, liquidity provision, and providing a customized UX, lowering the entry barrier for non-expert participants while optimizing micro-decisions at a scale beyond human capacity, all based on market principles.

Third, a reward structure that is scalar and option-like, where compensation varies continuously with the degree of KPI achievement rather than being 'winner-take-all,' allows for the design of more nuanced and performance-oriented incentives. This imposes real 'skin-in-the-game' for both proposers and participants, holding them financially accountable for poor decisions and clearly rewarding success, thereby preventing governance corruption and fostering a culture of responsibility.

Finally, this model offers practical solutions to new problems that are difficult to solve with existing governance systems, such as imbuing memecoins with purpose or managing the orderly process of a CTO(Community Takeover). By providing an in-depth analysis of this architecture's specific design, technical foundations, economic effects, and potential risks and mitigation strategies, this report offers a blueprint for DAO to evolve into information-based organizations that allocate capital and influence based on verifiable performance.